Understanding Gold IRA Kits: A Comprehensive Information

페이지 정보

작성자 Alvin 작성일 25-09-05 17:58 조회 3 댓글 0본문

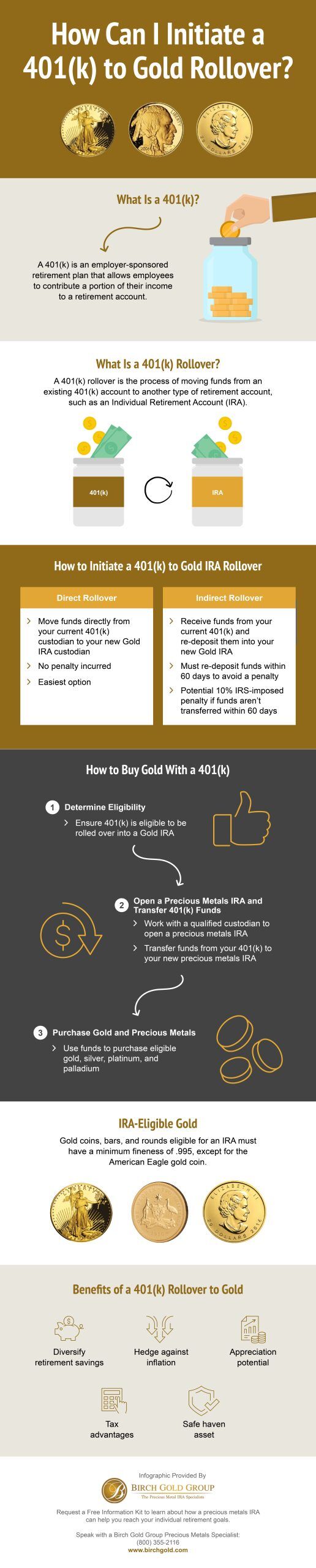

Investing in gold has lengthy been thought to be a reliable strategy for wealth preservation and portfolio diversification. With the rise of self-directed retirement accounts, Gold Particular person Retirement Accounts (IRAs) have gained reputation among investors looking to secure their financial futures. This report delves into the essentials of Gold IRA kits, exploring their parts, benefits, and issues for traders.

What's a Gold IRA?

A Gold IRA is a sort of self-directed IRA that allows buyers to carry bodily gold, as well as different precious metals like silver, platinum, and palladium, inside their retirement accounts. If you enjoyed this post and you would certainly like to get more info concerning stranded 401k to gold kindly browse through our own web page. Unlike traditional IRAs that sometimes invest in stocks, bonds, and mutual funds, a Gold IRA supplies a novel alternative to spend money on tangible property. This can be particularly appealing throughout times of economic uncertainty, as gold is commonly viewed as a secure haven asset.

Components of a Gold IRA Kit

A Gold IRA kit is a comprehensive bundle designed to help investors arrange and handle their Gold IRA accounts. These kits usually embrace a number of important elements:

- Account Setup Directions: The kit offers detailed steps on how you can open a Gold IRA account with a custodian. This consists of filling out necessary forms, selecting the type of account, and understanding the fees involved.

- Custodian Data: Gold IRAs have to be managed by an IRS-accepted custodian. The kit will often embrace a list of beneficial custodians, along with their contact information and services provided.

- Investment Choices: A Gold IRA kit will define the kinds of valuable metals that may be included in the account. This usually consists of IRS-authorised bullion coins and bars, such as American endorsed Gold IRA rollover Eagles, Canadian Gold Maple Leafs, and Gold bars from recognized refiners.

- Storage Solutions: Bodily gold have to be stored in a safe facility. The equipment will present data on numerous storage choices, including segregated storage (the place your gold is saved separately from other traders' property) and commingled storage (the place assets are stored collectively).

- Tax Implications: Understanding the tax implications of a Gold IRA is crucial. The kit will often embody data on how contributions, distributions, and withdrawals are taxed, in addition to the benefits of tax-deferred development.

- Investment Strategies: Some kits supply guidance on investment strategies, helping investors understand the right way to diversify their holdings within their Gold IRA and the potential dangers involved.

Benefits of a Gold IRA Kit

Investing in a Gold IRA kit affords quite a few advantages:

- Diversification: Gold often moves independently of inventory markets, making it a superb hedge towards market volatility. Including gold in a retirement portfolio can improve diversification and reduce overall risk.

- Inflation Hedge: Gold has historically maintained its worth over time, making it an efficient hedge towards inflation. As the purchasing energy of fiat currencies declines, gold tends to retain its value.

- Tangible Asset: In contrast to stocks or bonds, gold is a physical asset that buyers can hold. This tangibility can provide peace of thoughts, especially throughout economic downturns.

- Tax Benefits: Gold IRAs provide tax-deferred development, allowing investments to grow with out instant tax implications. Moreover, certified distributions in retirement are taxed at unusual income charges, which can be helpful for traders in decrease tax brackets.

- Wealth Preservation: Many buyers view gold as a retailer of value. In instances of geopolitical instability or financial crises, gold may admire in worth, serving to to preserve wealth.

Issues Before Investing

Whereas Gold IRA kits supply a number of benefits, there are necessary issues to remember:

- Charges: Organising a Gold IRA can involve varied fees, including account setup charges, annual upkeep fees, and storage charges. It is important to grasp these prices and how they could influence your total investment.

- Market Volatility: Although gold is often considered a secure haven, its price can nonetheless be risky. Traders needs to be ready for fluctuations within the gold market and have an extended-time period funding technique in place.

- Regulatory Compliance: Gold IRAs should comply with IRS rules. This contains adhering to rules relating to the forms of valuable metals that may be held and ensuring proper storage. Failure to conform can lead to penalties or disqualification of the IRA.

- Limited Funding Options: Whereas gold generally is a helpful addition to a portfolio, it should not be the only real funding. A effectively-rounded portfolio sometimes includes a mixture of asset courses to achieve optimal diversification.

- Custodian Choice: Selecting the best custodian is crucial for managing a Gold IRA. Traders ought to research potential custodians, contemplating elements equivalent to status, fees, and customer support.

Steps to Get Began with a Gold IRA Kit

For these taken with investing in a Gold IRA, the following steps may also help facilitate the process:

- Research and Select a Custodian: Begin by researching IRS-accredited custodians focusing on Gold IRAs. Evaluate their fees, providers, and customer reviews to search out a suitable possibility.

- Open an Account: Once a custodian is chosen, comply with the directions offered within the Gold IRA kit to open an account. This sometimes involves completing application types and funding the account through a transfer or rollover from an existing retirement account.

- Select Valuable Metals: Overview the funding options outlined within the equipment and decide which gold and other precious metals to incorporate in your IRA. Be sure that the chosen metals meet IRS necessities.

- Arrange for Storage: Work with your custodian to arrange safe storage to your physical gold. Guarantee that you perceive the storage fees and the level of security offered.

- Monitor Your Funding: Usually assessment your Gold IRA investment to make sure it aligns together with your total retirement technique. Stay informed about market traits and adjust your holdings as essential.

Conclusion

A Gold IRA kit will be an invaluable useful resource for traders looking to incorporate gold into their retirement portfolios. By understanding the components of the equipment, the benefits of investing in gold, and the concerns concerned, individuals can make knowledgeable selections that align with their financial goals. As with every investment, thorough analysis and cautious planning are essential to maximize the potential of a Gold IRA.

- 이전글 Ufabet: Enjoy Thrilling Online Casino Gamings in Thailand

- 다음글 Understanding Gold IRA Accounts: A Complete Information

댓글목록 0

등록된 댓글이 없습니다.