Mastering Market Level Alerts

페이지 정보

작성자 Denisha 작성일 25-12-04 01:31 조회 2 댓글 0본문

Setting up alerts for key market levels is a powerful way to stay informed without constantly watching the charts.

Whether you are a day trader, swing trader, or long term investor تریدینگ پروفسور knowing when price approaches important support or resistance levels can help you make timely decisions.

First, pinpoint the critical support and resistance areas visible on your chart.

These are typically areas where price has reversed in the past, such as previous highs, lows, round numbers, or Fibonacci retracement levels.

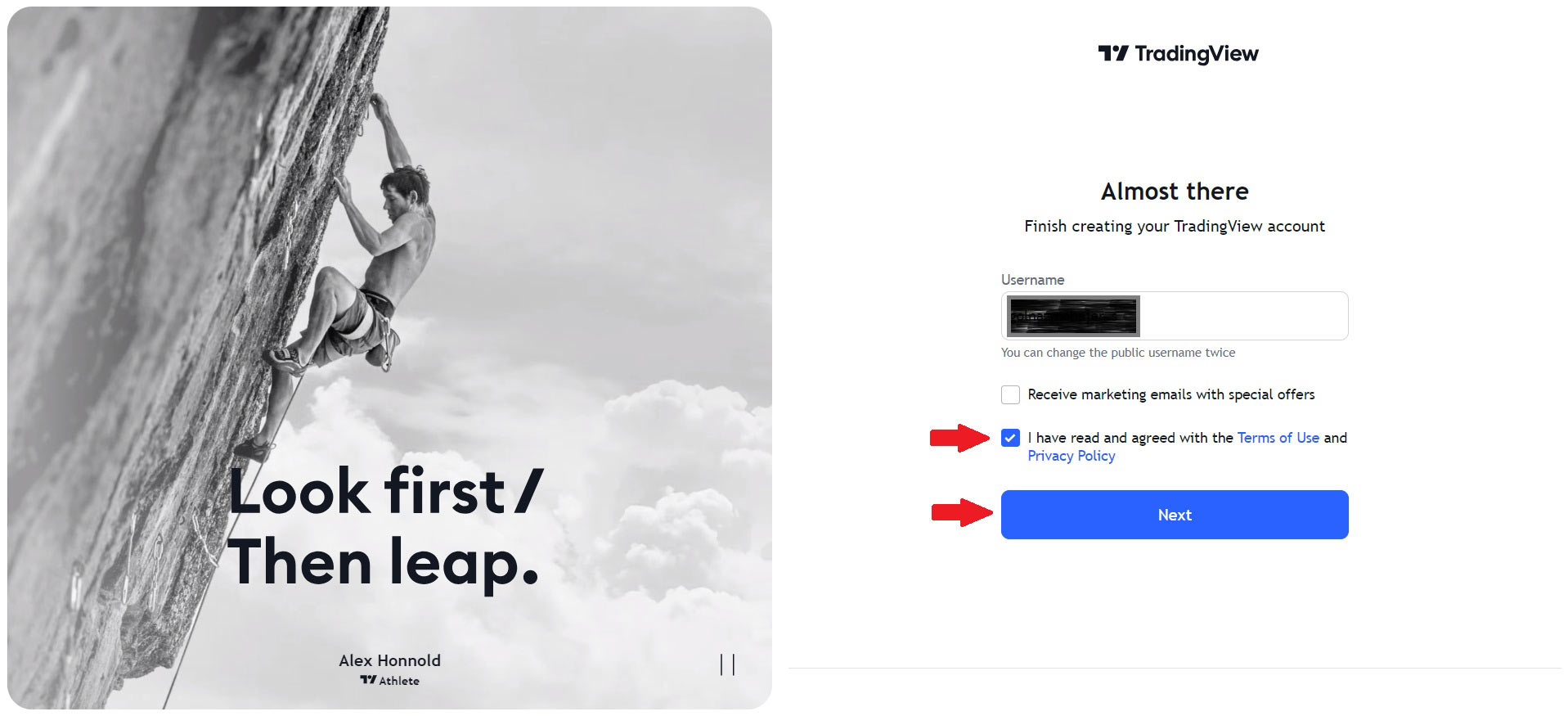

Once you have marked these levels, use your trading platform’s alert feature.

You can configure alerts on popular tools such as TradingView, cTrader, or MultiCharts.

Locate the price level on your chart and activate the alert setting from the context menu.

Configure alerts for price contact, breakout above, or breakdown below the level.

Don’t limit yourself—set alerts on daily, 4-hour, and 15-minute charts simultaneously.

A weekly or daily level often carries more weight than a short-term intraday level.

Layer in confirmation signals like OBV surges, MACD crossovers, or volatility expansions.

Choose your preferred delivery method: SMS, desktop pop-up, mobile push, or audio cue.

Validate your alert logic in a demo account before risking actual capital.

Keep your alert list lean and strategic.

Prioritize levels that match your entry and exit criteria.

Excessive alerts desensitize you and reduce reaction accuracy.

Refresh your support and resistance levels when the market structure shifts.

By setting up smart alerts, you turn passive observation into proactive trading.

- 이전글 Avoid The top 10 身體撥筋教學 Mistakes

- 다음글 Guide To Conservatory Upgrade Specialist: The Intermediate Guide To Conservatory Upgrade Specialist

댓글목록 0

등록된 댓글이 없습니다.